First Time Investors: Should You Invest in a House or Unit?

If we asked every first-time investor whether they should invest in a unit or a house, we would be asking the wrong question. For many first-timers seeking to invest in Australian property, their decision comes down to whether an apartment or house would create the most profit. While your goal as an investor is to make a profit, you need to take a step back and look at the bigger picture.

Instead of looking just at the pros and cons of owning a unit versus a house, getting into the investment market is just that – getting into the market. A successful investment is dependent on first and foremost the state of the market, secondly, the social and economic development factors surrounding your investment and thirdly, your own individual financial position, risk profile and investment strategy.

The Managing Director at Propertyology, Simon Pressley, told realestate.com.au that “comparing units and houses as a property investor is like comparing banking stocks and medical stocks as a share investor. It is all dependent on the state of the market, whether that be the property market or the stock market.”

The key…? Research!

Before committing yourself to an investment, you must do your research. You’ll need to know the economics behind your options; what is happening in the unit or housing market? What is currently driving the economy? Where are important epicentres of economic growth? You’ll need to understand the supply and demand of your choice; how many houses or units are available? How many will become available in the future? What is being improved in the area? Finally, you’ll need to assess the affordability of your options; what areas are in high demand? Can I afford what is on offer in those areas? Can I take a risk, knowing it will most likely pay off in the future?

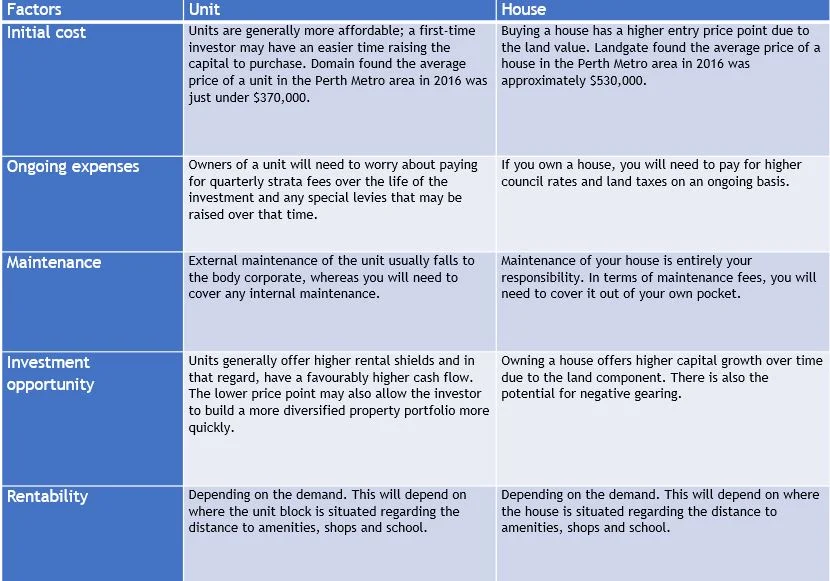

Factors to consider for each option

Pressley continued, “when it comes to property, somehow people get sidetracked by the fact that property is a tangible asset, one that we can see and touch. What’s important is for the investor to not focus on the property itself, but instead to focus on the market. A property itself is a static commodity; it’s the market around it that grows.”

While there are pros and cons to each dwelling type, first-time investors must put their effort into researching the current market, locations in high demand and the type of property that will most benefit their financial circumstances and strategy.

At Select, we offer free, no-obligation and quality advice to help you reach your financial goals. If you are a first-time investor, we can help find the loan that best suits your circumstances. Give us a call on (08) 9417 3399 to make an appointment with one of our brokers.